A few months back we got a call from an investor in California who'd just closed on a duplex in Southwest Atlanta. He'd found it on an auction site, ran the numbers through a rental calculator, and bought it sight unseen. On paper, the deal looked like an 11% cap rate. In reality, the property sat in a flood zone, needed $47,000 in foundation work, and the "projected rents" from the listing were about $400 a month higher than anything the neighborhood actually supports.

We hear some version of this story every month. Atlanta shows up on every "Top Markets for Real Estate Investors" list, and for good reason. But those lists don't tell you that the difference between a great deal and a money pit can come down to which side of a street you're on. Two houses three blocks apart in the same zip code can have completely different cap rates, tenant quality, and appreciation trajectories.

So here's what we actually tell investors when they call. Not the sales pitch. Not the YouTube guru version where every neighborhood is "up and coming." Which areas pencil out, which ones are overhyped, what the real numbers look like, and where the experienced local investors are actually buying right now.

Why Atlanta Keeps Showing Up on Every Investor's List

Let's get the macro stuff out of the way quickly because you've probably already read this part elsewhere. Georgia added over 100,000 net new residents in 2025, and metro Atlanta absorbed the majority of that growth. The big drivers are corporate relocations (Microsoft leases 500,000+ square feet at Atlantic Yards in Midtown, Google's presence is growing downtown, Rivian broke ground on a $5 billion plant east of the city near Social Circle with production expected in 2028) and the film industry, which generated $4.4 billion in direct production spending at its peak and still employs tens of thousands of people who need housing even as the industry rebounds from the 2023 writers' strike.

What actually matters for investors: rents across metro Atlanta grew about 2.5% year over year through 2025, with one-bedroom apartments up 4.3% and single family homes up 2.1% as of Q3 2025. New apartment deliveries are expected to drop nearly 50% in 2026, which should push vacancy down and rents up further. The price-to-rent ratio still favors landlords here compared to most Sun Belt markets. Tampa and Nashville have caught up on pricing without the rent growth to match. Phoenix has overcorrected. Atlanta still has room.

And Georgia is a landlord-friendly state. The eviction process, while never pleasant, takes roughly 30 to 45 days, not the 6 to 12 months you'd face in California or New York. Security deposit rules are straightforward. No rent control. No mandatory relocation assistance. This isn't a political statement, it's just the legal framework, and it affects your downside risk as an investor.

Which Investment Strategies Actually Work Here

Every strategy has a place in Atlanta, but not every strategy works in every neighborhood. Here's the honest breakdown before we get into specific areas.

Long-term rentals are the bread and butter. Single family homes in the $200K-$400K range with 3 bedrooms and at least 2 baths rent quickly and hold tenants well. This is where most of the smart money is.

Short-term rentals and Airbnb are more complicated than people realize. The City of Atlanta requires a short-term rental license. If it's not your primary residence, you need a commercial license, and enforcement has gotten serious. We've seen investors get hit with fines of $500 per violation per day. Unincorporated DeKalb County has been more permissive, and some suburban cities haven't caught up with regulation yet. But this is changing fast. Don't build your investment thesis on STR income inside city limits unless you've confirmed the licensing situation with an attorney.

Fix and flip still works in specific pockets where there's a wide spread between distressed and renovated prices. The best margins are in transitional neighborhoods where a renovated home sells for $350K+ but you can buy unrenovated for under $200K. Rehab costs have increased roughly 15% since 2023, so your budget needs to account for that. We'll cover the best flip neighborhoods below.

BRRRR (buy, rehab, rent, refinance, repeat) is alive and well, but the refinance piece has gotten tighter with higher rates. You need to be disciplined about your all-in cost relative to after-repair value. The days of getting 80% of ARV back on a cash-out refi are largely behind us. Plan for 70-75%.

House hacking (buying a duplex or triplex, living in one unit, renting the others) is probably the most underused strategy in Atlanta. There are still duplexes in Kirkwood, East Atlanta, and Grant Park in the $350K-$450K range where the rental unit covers most of your mortgage. FHA financing at 3.5% down makes the entry point very accessible.

Luxury and executive rentals are the strategy nobody writes about because most real estate investors aren't playing at that price point. But Atlanta's film industry generates massive demand for high-end furnished homes. Tyler Perry Studios, Trilith Studios (home to over a decade of Marvel blockbusters), and a half-dozen other production facilities mean there are A-list actors, directors, and production executives who need 4-6 month housing during shoots. They're not staying at Extended Stay America. They want a $2-5M home in Buckhead with a pool, privacy, and a gate. Corporate relocations at the C-suite level create similar demand. A $3M home in Tuxedo Park or Chastain Park that might rent for $10,000-$15,000/month on a traditional lease can command $25,000-$45,000/month furnished on a short-to-mid-term basis. The cash-on-cash math is completely different from the $228K rental down the page, and so is the tenant profile.

Atlanta Investment Neighborhoods at a Glance

Best for Cash Flow

- • East Point / College Park (6-7.5% cap rates)

- • Sylvan Hills / Oakland City (6.5-8%)

- • South Downtown corridor (5.5-7%)

Best for Appreciation

- • Westside / Vine City (BeltLine effect)

- • Adair Park / Capitol View (development wave)

- • Decatur / Brookhaven (established demand)

Best for Flips

- • Kirkwood / East Atlanta Village

- • West End / Westview

- • Sylvan Hills (emerging)

Best for Suburban Cash Flow

- • Smyrna / Vinings (5.5-7%)

- • Sandy Springs / Dunwoody (corporate rentals)

- • East Cobb / Marietta (family demand)

Best for Luxury / Executive Rentals

- • Buckhead / Tuxedo Park ($25K-$45K/mo)

- • Chastain Park / Peachtree Battle

- • Sandy Springs estates (film industry)

The Neighborhoods: Where the Numbers Actually Work

This is the part that matters. We're going to cover the areas where we see the most investor activity and break down what's actually happening on the ground. Not every neighborhood gets equal treatment here because they're not equal opportunities.

Westside, Vine City, and Washington Park

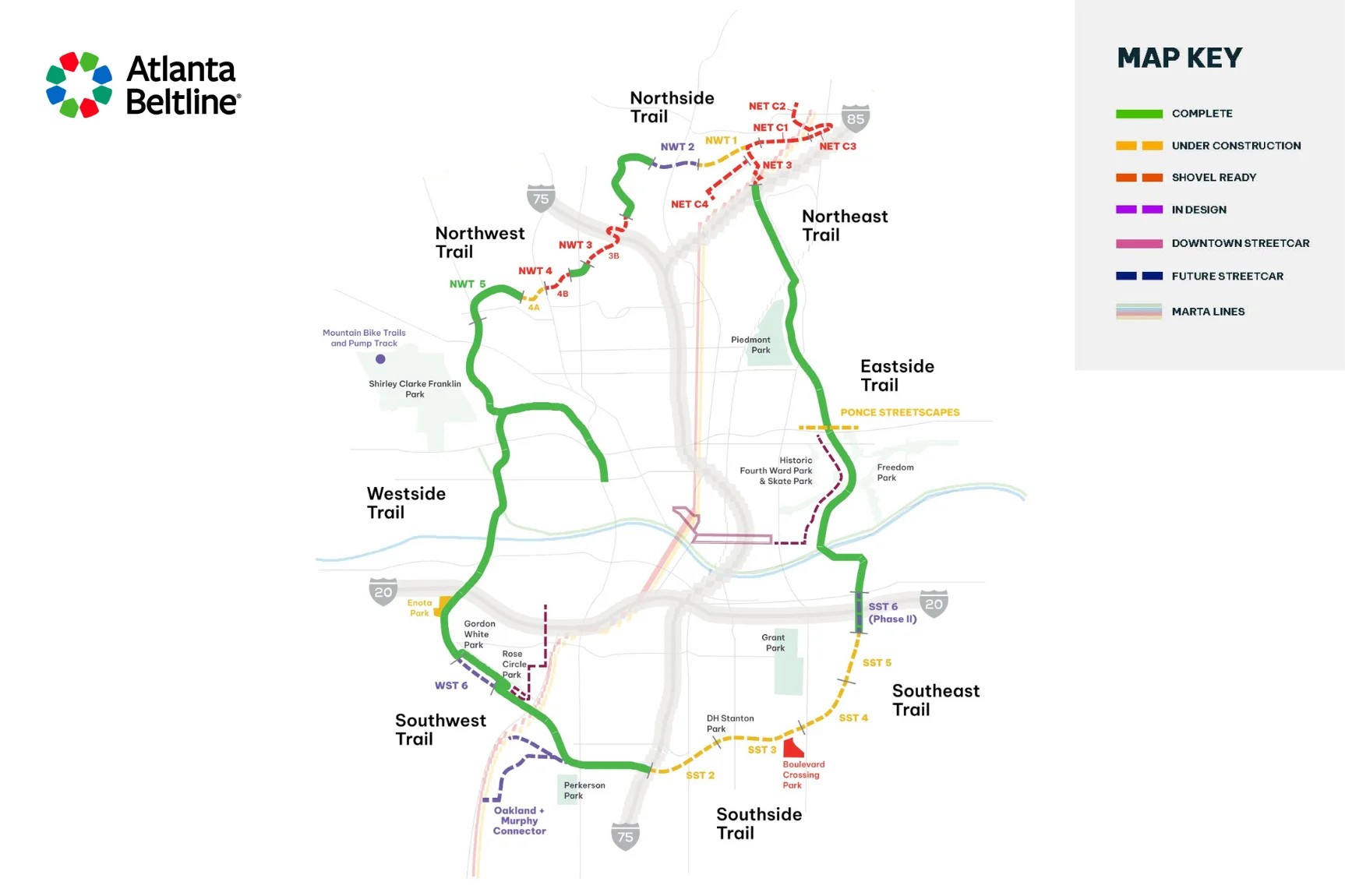

This is the area we get asked about the most, and the answer is complicated. The Westside is ground zero for Atlanta's biggest transformation. The BeltLine Westside Trail is complete, Centennial Yards is actively under construction, and Westside Park (built on the old Bellwood Quarry) is the largest free-entry urban green space in Atlanta at 280 acres. Money is pouring in.

Median home prices in Vine City have jumped from around $165K in 2021 to roughly $310K today. That's nearly double in five years. The investors who got in early made out extremely well. The question is whether there's still room to run.

Our honest take: the easy money has been made. You can still find deals, but the cap rates have compressed to the 5-6% range on renovated properties, and the entry point is significantly higher than it was even two years ago. Where we still see opportunity is on unrenovated properties that need work, particularly in Washington Park where prices lag Vine City by $40-60K for comparable lots. But you need to know construction costs and you need to move fast because other investors are watching the same blocks.

The downside: Property crime is still elevated compared to other investment areas. Some blocks have turned over beautifully while others haven't. The disparity can be stark within a half mile. Street-level knowledge matters here more than anywhere else in the city. If you're buying from out of state, you absolutely need a real estate agent on the ground who walks these neighborhoods regularly.

East Point, College Park, and Hapeville

The airport corridor is, in our opinion, the most undervalued rental market in metro Atlanta right now. East Point in particular has a lot going for it. MARTA access, proximity to the airport (which means a steady pipeline of Delta employees, airline contractors, and logistics workers who need housing), and a charming historic downtown that's starting to attract restaurants and retail.

Median purchase price for a 3-bedroom rental: around $215K. Average rent for a renovated 3BR: $1,650-$1,800. That puts your gross yield in the 9-10% range before expenses, which is strong for the Atlanta market. But gross yield is not cash flow. After accounting for your mortgage at current rates, management (8-10% of gross rent), taxes, insurance, and maintenance reserves, monthly cash flow with 25% down is going to be tight or slightly negative. The real returns here come from the combination of principal paydown, depreciation benefits, and appreciation in an area with strong fundamentals. We break down the actual math further down in this post.

College Park is similar but rougher around the edges. Prices are lower (median around $175K for investment-grade properties) and rents are proportionally lower too. The upside play in College Park is the massive mixed-use development happening around the airport and the continued expansion of Atlanta's film industry, with several studios operating nearby. Hapeville is the smallest of the three but benefits from the Porsche headquarters and experience center, which has quietly upgraded the area.

The downside: Some areas of College Park have persistent vacancy issues. Flight path noise is real for properties directly under the approach to Hartsfield-Jackson, and some tenants care about that more than you'd think. Insurance costs in this area have risen sharply since 2024 because of claims history. Get quotes before you underwrite a deal, not after.

South Downtown, Capitol View, and Adair Park

South Downtown is the speculative play of the moment. A private investor group purchased 57 buildings across 16 acres and is redeveloping the entire area. The BeltLine's Southside Trail expansion will eventually connect through here. And the development activity from Centennial Yards is pushing south.

Capitol View and Adair Park sit just south of the BeltLine corridor and have become magnets for investors looking for the "next Kirkwood" (more on Kirkwood below). Median prices in Adair Park have crossed $325K for renovated homes, up from $195K five years ago. Capitol View is trailing by about 12-18 months in the same pattern, with renovated homes trading around $285K.

The investment case here is more appreciation than cash flow. Cap rates on renovated buy-and-holds are in the 5-6.5% range. But if the BeltLine Southside Trail completion happens on schedule (expected 2027-2028), properties within a quarter mile of the trail could see the same 20-30% appreciation premium that happened along the Eastside Trail. That's the bet.

The downside: "On schedule" is doing a lot of heavy lifting in that sentence. BeltLine timelines have slipped before. If you're counting on trail completion to hit your target returns, you're making a bet on government infrastructure timing, and that's inherently risky. Buy at a price that works even if the trail is delayed by two years.

Kirkwood and East Atlanta Village

If you'd asked us five years ago for the best investment neighborhood in Atlanta, we'd have said Kirkwood without hesitation. The area has gentrified significantly, the BeltLine runs right through it, and rental demand from young professionals is as strong as anywhere in the city.

The challenge now is that Kirkwood has priced out most cash-flow investors. Renovated 3-bedroom homes are trading at $425K-$475K and renting for $2,000-$2,200. That's a 5.5-6% gross yield before expenses. After expenses, you're looking at thin margins for a buy-and-hold. The play in Kirkwood today is flips (the spread between unrenovated and renovated is still $150K+) or house-hacking a duplex if you can find one.

East Atlanta Village (EAV) is Kirkwood's slightly more affordable neighbor to the south. Median prices are about $50K lower for comparable properties, and the rental market is strong because of the walkable restaurant and bar scene around the village center. We see better cash flow numbers here, typically in the 6-7% cap rate range.

The downside: Both areas have HOA pockets where rental restrictions apply. Some of the newer townhome communities limit rentals to 20-25% of units. Always, always check the HOA docs before you close. We've seen investors get stuck with properties they can't legally rent because they didn't read the covenants.

Sylvan Hills and Oakland City

These Southwest Atlanta neighborhoods are where the most aggressive investors are buying right now. Median prices are still in the $160K-$220K range for 3-bedroom homes, and rents have climbed to $1,400-$1,650. The cap rates are the best in the city for properties that aren't total gut jobs. Oakland City in particular sits directly on the BeltLine's planned Westside Trail extension.

The downside: These neighborhoods have real challenges. Higher crime rates, older housing stock that can hide expensive problems (galvanized plumbing, knob-and-tube wiring, foundation issues from Atlanta's red clay soil), and a tenant pool that trends toward Section 8 vouchers. Section 8 isn't inherently bad for investors (guaranteed rent payments and lower vacancy), but it comes with inspection requirements and bureaucratic timelines that some landlords find frustrating. You need to go in with realistic expectations about the management intensity.

Smyrna and Vinings

If you want suburban cash flow without the management headaches of more urban neighborhoods, Smyrna is worth a serious look. It's in Cobb County (lower property taxes than Fulton), has excellent schools, and consistently ranks as one of the most desirable suburbs in the metro. Median investment property price: $340K-$380K for a 3BR. Rents: $1,800-$2,100. Cap rates in the 5.5-6.5% range, which is solid for a low-maintenance suburban market.

Vinings is Smyrna's upscale neighbor, with prices running $50-100K higher for comparable homes. The tenant profile tends toward corporate professionals, which means lower turnover and fewer late payments. But the cap rates dip into the 4.5-5.5% range, making it more of an appreciation play.

Decatur and Brookhaven

We'll be straight with you: these are not cash flow markets. Decatur and Brookhaven are appreciation plays. Median home prices are $475K-$550K+, and while rents are strong ($2,200-$2,600 for renovated 3BRs), the numbers don't produce meaningful monthly cash flow at current interest rates. What they do offer is consistent appreciation in the 6-8% annual range, strong tenant demand from professionals who want top-rated schools without living in the far suburbs, and very low vacancy.

If your strategy is long-term wealth building through equity appreciation and you're not dependent on monthly cash flow, these are among the safest bets in the metro. Decatur in particular has a walkable downtown, a beloved food scene, and the kind of community character that sustains property values through downturns.

Sandy Springs and Dunwoody

The corporate rental play. Along with Buckhead, Sandy Springs is home to a growing number of corporate headquarters (Mercedes-Benz USA, Inspire Brands, Cox Enterprises) and Dunwoody has the Perimeter Center business district. This creates steady demand for furnished and unfurnished rentals from relocating professionals, typically on 1 to 2 year leases while they figure out where to buy.

The investor angle here is premium rents with premium tenants. A well-located 3BR in Sandy Springs rents for $2,400-$2,800. Furnished corporate rentals can hit $3,200-$3,500. Prices run $400K-$500K for investment-grade homes. The cap rates are moderate (5-6%), but the tenant quality and appreciation trend make up for it. Dunwoody is similar but with slightly lower entry points and a bit more townhome inventory, which can work well for investors who want lower maintenance.

Buckhead: The Luxury Rental Play

Most investment guides skip Buckhead entirely because the entry point scares people. Median home prices among Buckhead's premier enclaves, Tuxedo Park, Chastain Park, Peachtree Battle, and the Paces neighborhoods, run $1.5M to $5M+. That's not a traditional rental investment. But the luxury rental market in Atlanta operates on completely different economics, and it's driven by something most markets don't have: a multi-billion-dollar film industry (spending hit $4.4 billion at its peak in 2022 and still runs north of $2 billion annually) that needs housing for talent.

Here's how it works. A major production shoots at Trilith Studios or Tyler Perry Studios for 4 to 7 months. The lead actors, directors, and senior producers need homes, not hotel rooms, homes with privacy, space, a pool, maybe a gated entrance. Their production companies lease furnished properties at $25,000 to $45,000 per month depending on the caliber of the talent and the property. We've seen properties in Tuxedo Park leased at $38,000/month for a 5-month shoot. That's $190,000 in gross rental income from a single tenant on a single engagement.

Corporate C-suite relocations add to this. When a Fortune 500 exec takes a role at one of Atlanta's headquarters (Coca-Cola, Delta, UPS, Home Depot, the growing fintech sector), they often rent high-end for 6 to 12 months while their family finishes the school year or while they decide on a permanent neighborhood. Monthly rents of $10,000-$15,000 for a furnished 5-bedroom in Chastain Park are standard for this tenant class.

The math on a $3M Buckhead property: if you can achieve even 8 to 9 months of luxury occupancy per year at an average of $28,000/month, that's $224K-$252K in annual gross rent. After management (luxury property managers typically charge 12-15%), taxes, insurance, and maintenance on a high-end home, you're looking at net yields that compete with or beat the cash flow on a $228K ranch in East Point, just with a very different risk profile and capital requirement. The appreciation upside is significant too. Buckhead's top-tier neighborhoods have averaged 5-7% annual appreciation over the last decade, and that's on a much larger base.

The downside: This is not passive investing. Luxury tenants expect everything to work flawlessly, and when a $35,000/month tenant calls about the pool heater, you respond immediately. Vacancy risk is real because you're dependent on production schedules and corporate relocation cycles. Maintenance costs on a $3M+ home are substantially higher. And the capital requirement obviously limits who can play in this space. But for investors with the means, Atlanta's luxury rental market is one of the more compelling opportunities in the Southeast specifically because of the film industry pipeline that doesn't exist in most other cities.

Running the Numbers: A Real Deal Breakdown

Theory is fine. Let's look at what an actual deal looks like. This is based on a property we helped an investor analyze in East Point late last year. The numbers are representative of what you'll find in that market right now.

Sample Deal: 3BR/2BA Ranch in East Point

Acquisition

Monthly Cash Flow

Cash-on-cash return: -1.6%. Wait. Negative? Yes. At a 7.125% mortgage rate with 25% down, this deal doesn't cash flow monthly. And that's the reality in 2026 for a lot of "cash flow" properties that look great on a YouTube thumbnail. The actual return here comes from principal paydown (about $137/mo going to equity in year one, growing each year), tax benefits (depreciation sheltering rental income), and appreciation. Factor in all three and total return lands in the 8-12% range annually depending on how the neighborhood appreciates. But if you need monthly checks from day one, you either need a bigger down payment, a lower purchase price, or a different market.

We show this example because too many investment analyses cherry-pick numbers to make deals look better than they are. A 5% vacancy assumption is aggressive for some areas. Insurance at $135/month for a landlord policy is current, but it was closer to $95/month two years ago and it's still climbing. Being honest about the numbers upfront prevents the kind of surprise that sinks investors in year two.

Want this deal to cash flow? Put 35% down instead of 25% and the monthly flips to about $55 positive. Or buy at $195K (harder to find but possible off-market) and you're positive at 25% down. The math is the math. We just want you to see real numbers before you get excited about theoretical returns.

Now Run the Same Exercise at $3.2M

Completely different math. Here's what a luxury executive rental looks like in Buckhead, based on a property we consulted on last year in the Chastain Park area.

Sample Deal: 5BR/5.5BA Estate in Chastain Park

Acquisition

Annual Income (9 months occupied)

Cash-on-cash return: -4.1%. Negative again on a pure cash flow basis when you're carrying a mortgage. But here's where luxury diverges from standard rentals. Many investors at this level purchase all-cash or with 50%+ down, which eliminates the mortgage line entirely. At a cash purchase, the net operating income is roughly $147,000/year on a $3.2M property, a 4.6% return before appreciation. Factor in Buckhead's 5-7% annual appreciation on a $3.2M base (that's $160K-$224K in equity growth per year) plus depreciation on both the structure and the $175K in furnishings, and total annual returns can exceed 10-12%. And you're building equity in a trophy asset in one of the Southeast's most desirable zip codes.

The wildcard with luxury rentals is occupancy. Nine months of bookings in a year is optimistic and depends on Atlanta's production calendar, which fluctuates with strikes, tax incentive changes, and studio capacity. In a strong production year, 9-10 months is achievable. In a slow year, you might get 5-6 months, which changes the math dramatically. That's why most luxury rental investors also list their properties for traditional long-term leases at $10,000-$15,000/month as a fallback, or keep them partially available for their own use.

The point of showing both deal examples is that "investment property in Atlanta" means completely different things depending on your capital, risk tolerance, and strategy. A $228K ranch in East Point and a $3.2M estate in Chastain Park are both legitimate investment plays. They just serve different investors.

What Trips Up Atlanta Investors

We see the same mistakes repeatedly. Here are the ones that cost the most money.

Trusting online rent estimates. Zillow's Rent Zestimate and similar tools are often $200-400 off in Atlanta, sometimes higher, sometimes lower. They don't account for street-level differences, condition, or the fact that a 3BR with 1 bath rents for significantly less than a 3BR with 2 baths in the same zip code. Always pull actual comps from FMLS or talk to a local property manager before you underwrite.

Underestimating rehab on older homes. A huge portion of Atlanta's investment-grade housing stock was built between 1940 and 1970. That means potential issues with galvanized steel plumbing (replacement cost: $8,000-$15,000), outdated electrical panels, asbestos in popcorn ceilings or floor tiles, and foundation problems caused by Atlanta's expansive red clay soil. Get a thorough inspection. Budget 15-20% above your contractor's estimate for contingency. Seriously.

Ignoring HOA rental restrictions. We mentioned this in the Kirkwood section, but it applies across the metro. Many townhome and condo communities restrict the percentage of units that can be rented. Some have waiting lists for rental permits. A few prohibit investment purchases entirely by requiring owner occupancy for the first 12-24 months. Read the CC&Rs before you're under contract, not at the closing table.

Skipping the flood zone check. Parts of Southwest Atlanta, areas along Proctor Creek and Utoy Creek, and some pockets near the Chattahoochee sit in FEMA flood zones. Flood insurance adds $1,200-$3,000+ per year to your carrying costs. It doesn't show up on most investor calculators, and it can destroy your returns.

Not budgeting for property management. This one's mostly for out-of-state buyers. Self-managing a rental from 800 miles away almost never works long-term. Budget 8-10% of gross rent for a competent property manager. Atlanta has a deep bench of management companies, but quality varies widely. Get references from other investors, not from the management company's own website.

Financing and the Operational Side

The deal analysis only works if you can actually finance it and manage it. Here's the practical side.

Conventional investment loans typically require 25% down for single family, 25-30% for 2-4 units. Rates for investment properties are running 0.5-0.75% above primary residence rates, so expect 7-7.5% as of early 2026. You'll need 6 months of reserves (mortgage payments) in liquid assets after closing.

DSCR loans (debt service coverage ratio) are popular with investors who have multiple properties or non-traditional income. These qualify based on the property's income rather than your personal income. Rates are higher (typically 7.5-8.5%) but the qualification process is faster and they don't count against your conventional loan limit of 10 properties. Several national lenders and a handful of Atlanta-based portfolio lenders offer these.

Hard money for flips is readily available in Atlanta. Expect 10-13% interest with 2-3 points and a 12 to 18 month term. The Atlanta flip market is active enough that hard money lenders have a good understanding of ARVs by neighborhood. Just make sure your timeline and budget are realistic, because a hard money extension at 13% interest will eat your profit fast.

Property Tax: The County Matters

Taxes in metro Atlanta vary by county, and for investment properties the differences add up because you don't get the homestead exemption.

Effective Property Tax Rates (Non-Homesteaded)

Rates are approximate and based on assessed value (40% of fair market value in Georgia) multiplied by local millage rates. Non-homesteaded properties pay the full rate without exemptions. Always verify current rates with the county tax assessor.

Insurance: The Cost Nobody's Talking About

This deserves its own callout. Homeowners insurance premiums in Georgia have risen nearly 36% since 2019 according to LendingTree, with annual increases running 8-12% each of the last three years. The state average for owner-occupied homeowners policies is now about $2,870 per year. Landlord policies (DP-3) run somewhat lower since they don't cover personal property, but investment properties don't qualify for the rate breaks that owner-occupants get. On a $200K-$300K rental, expect $1,500-$2,000+ per year for a landlord policy, and rising. Add a roof older than 15 years and some carriers won't write you at all.

Factor this into your analysis. Get actual insurance quotes during your due diligence period, not after closing. And budget for continued increases of 5-8% annually when you're projecting multi-year returns.

Where Things Are Heading

Atlanta's investment market in 2026 is different from what it was even two years ago. Entry points are higher, interest rates are compressing margins, and the easy "buy anything in a gentrifying neighborhood" approach doesn't work anymore. The investors who are doing well right now are the ones who get granular about neighborhoods, honest about their numbers, and disciplined about not overpaying just because a street is near the BeltLine.

The 2026 FIFA World Cup is accelerating development timelines across downtown and the Westside. Over $10 billion in active development is reshaping the city in real time. For investors willing to do the homework and buy in the right spots, the next three to five years could be very rewarding. But "the right spots" is doing all the work in that sentence, and that's what we spend most of our time helping investors figure out.

If you're looking at Atlanta, call us. Not for a sales pitch, but for an honest conversation about whether what you're looking at makes sense. We'd rather talk you out of a bad deal than into a good one.

Want to Talk Through a Specific Deal?

Whether you're analyzing your first Atlanta property or adding to a portfolio, a quick conversation with our Atlanta realtors can give you clarity on the neighborhoods, numbers, and strategies that fit your goals.

Disclaimer: This article is for educational purposes only and does not constitute financial, legal, or investment advice. Market data, cap rates, and rental figures change frequently. Consult qualified professionals before making investment decisions.